Discovering the Need for Real-Time Updates

Real estate agents involved in transactions — whether representing buyers or sellers — face a common frustration: the lack of real-time updates on mortgage application progress. Without a reliable way to track the stages of the lending process, they are left spending precious time searching for information, following up on status updates, and addressing unforeseen issues. This inefficient communication can lead to delayed closings, misaligned expectations, and unnecessary back-and-forth between the agent, buyer, seller, and lender.

Key milestones like underwriting, document submission, appraisal ordering, and closing dates can be difficult to monitor, and often, agents lack a clear sense of where in the process each application stands. The absence of a streamlined system leads to confusion, inefficient workflows, and a lack of transparency, which in turn causes stress for all parties involved.

Building a Tracking Portal for Real Estate Agents

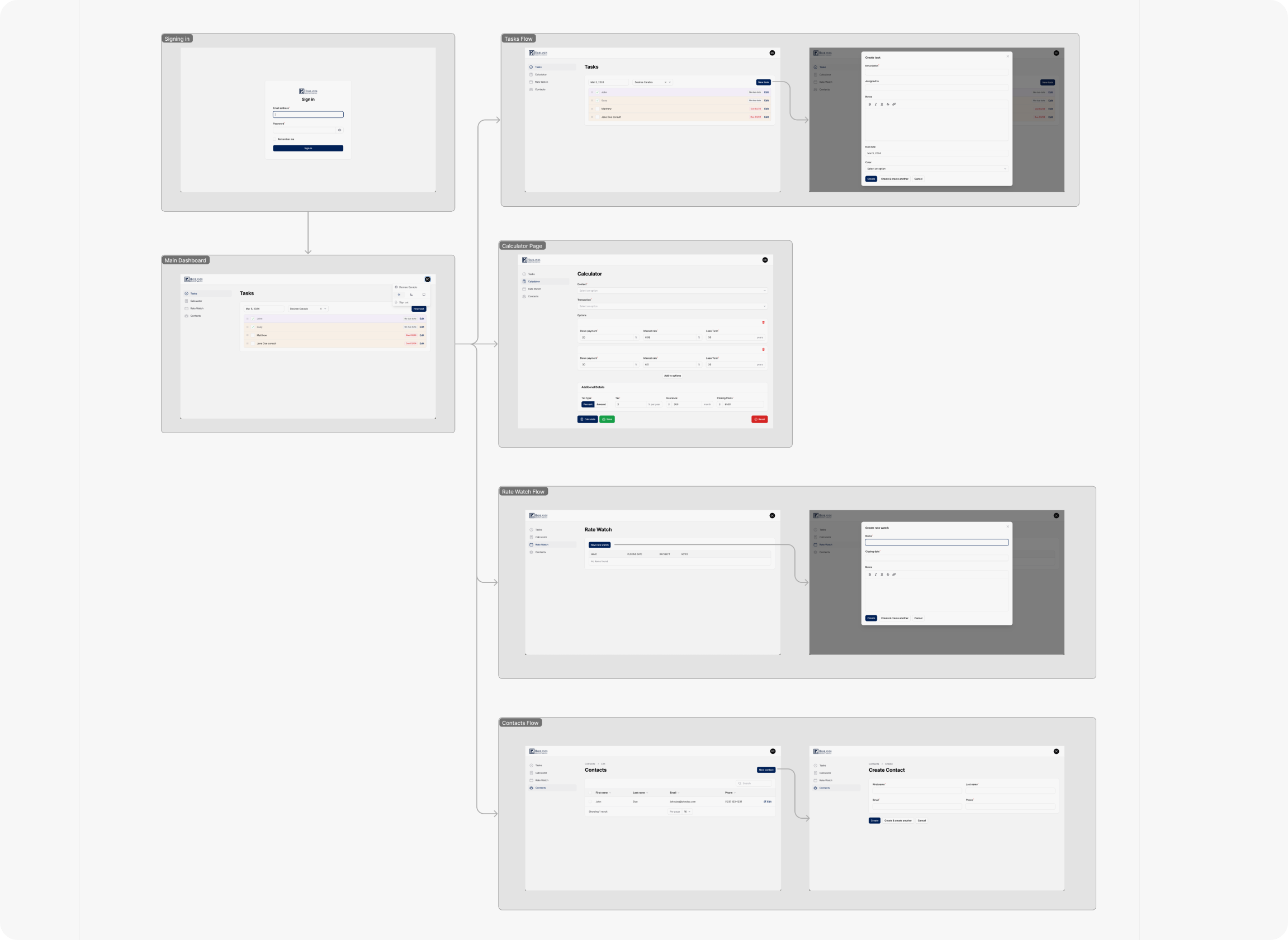

We began by examining their needs conducting a thorough audit. We identified areas for improvement by assessing features that would contribute most effectively to our goal.

By understanding the pain points, we set out to create a solution: a user-friendly portal designed specifically for realtors, where they could easily monitor the progress of mortgage applications in real-time. We believed that offering transparency throughout the mortgage process would reduce unnecessary communication and ensure realtors could focus on their core responsibilities, confident that they were always up to date.

We envisioned the portal as a one-stop hub, where agents would:

Access real-time updates on each stage of the lending process.

View clear visual indicators for milestones like underwriting completion, document collection, appraisal status, and closing readiness.

Receive alerts for critical issues, such as missing documents or deadlines.

Quickly identify how far along each loan process is, what still needs to be completed.

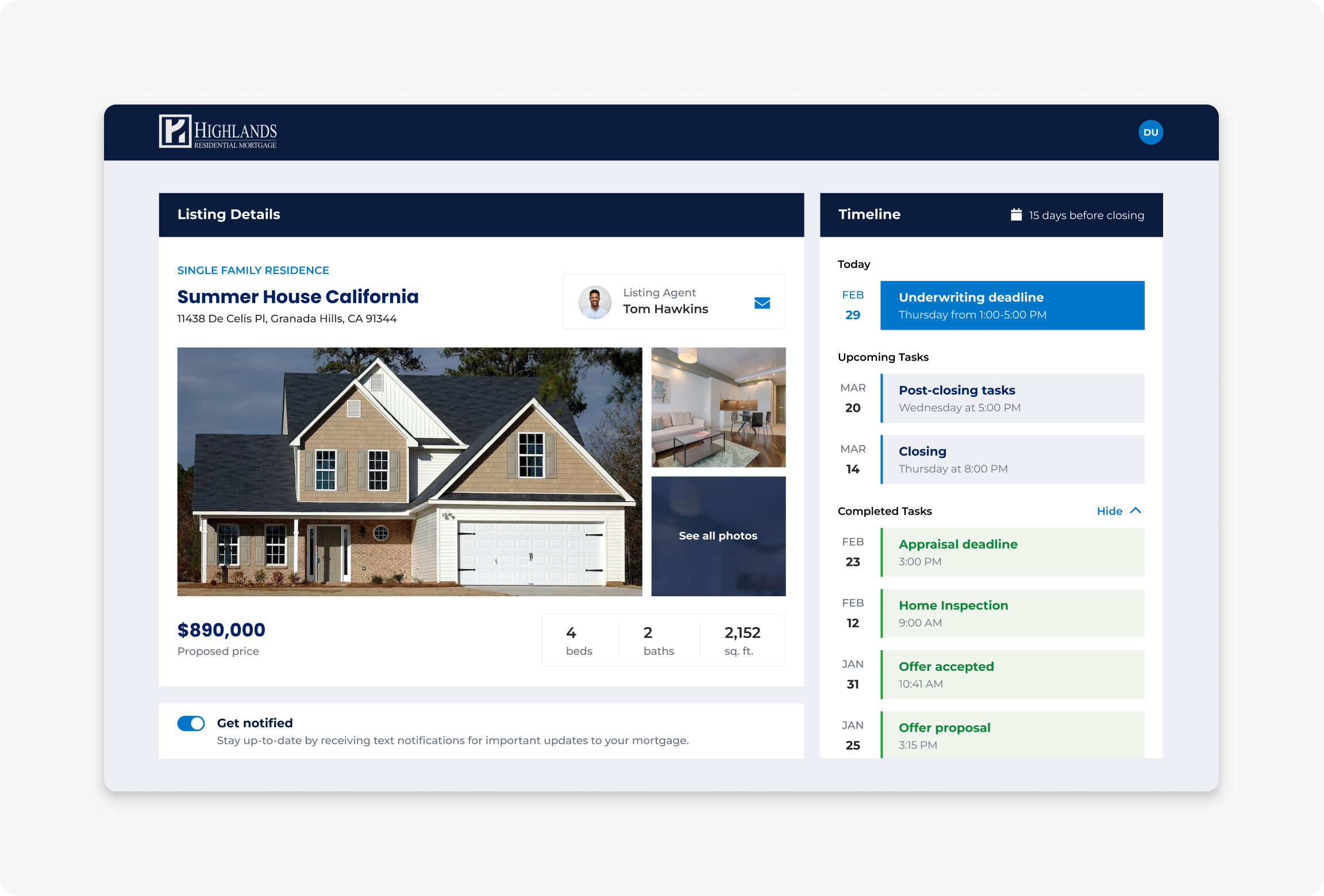

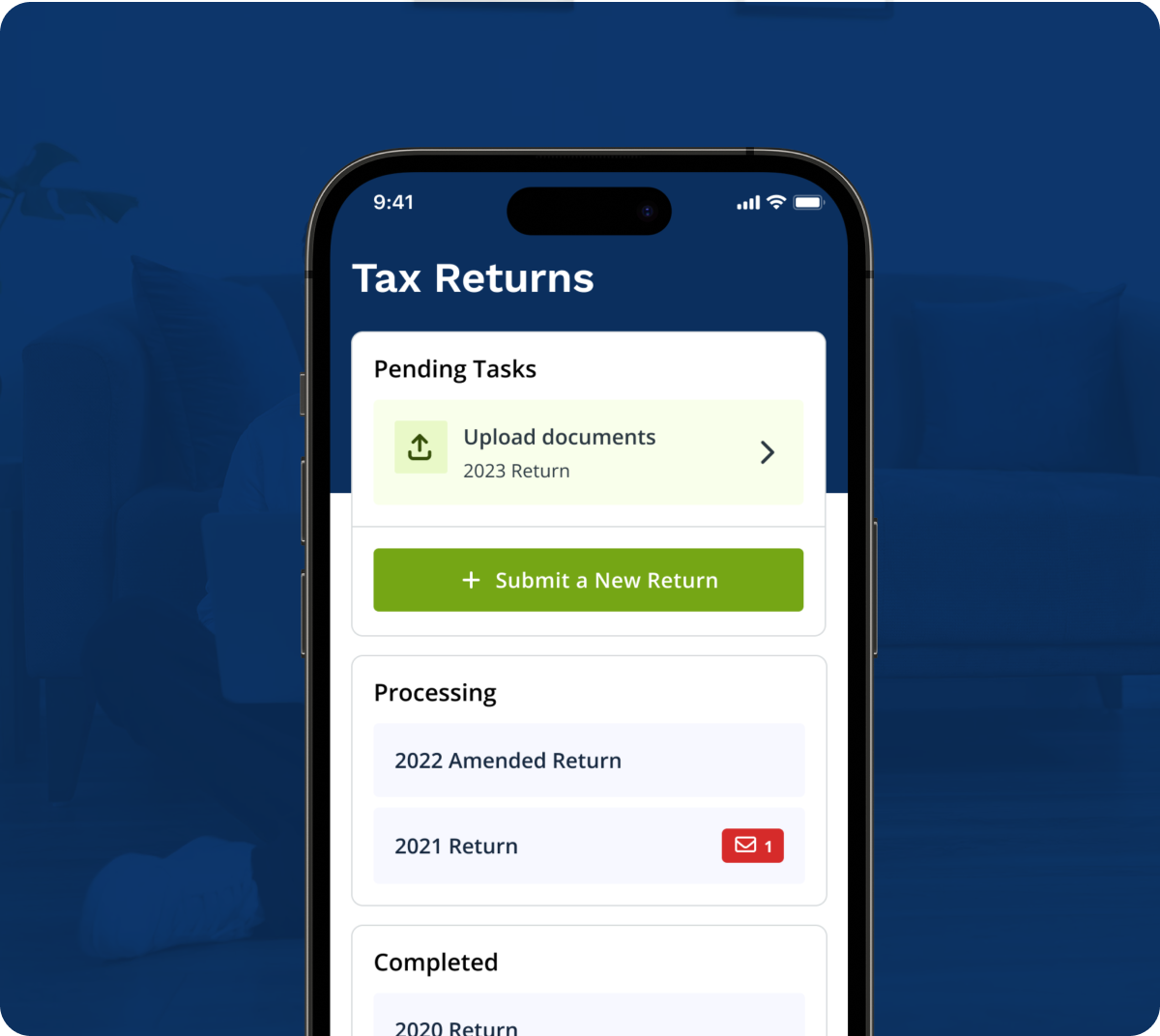

We began by breaking down the lending process into its key stages and identifying the critical information agents needed at each point. Our goal was to create an intuitive interface where agents could access this information at a glance, without needing to dive into excessive detail. This is how our initial design looked like:

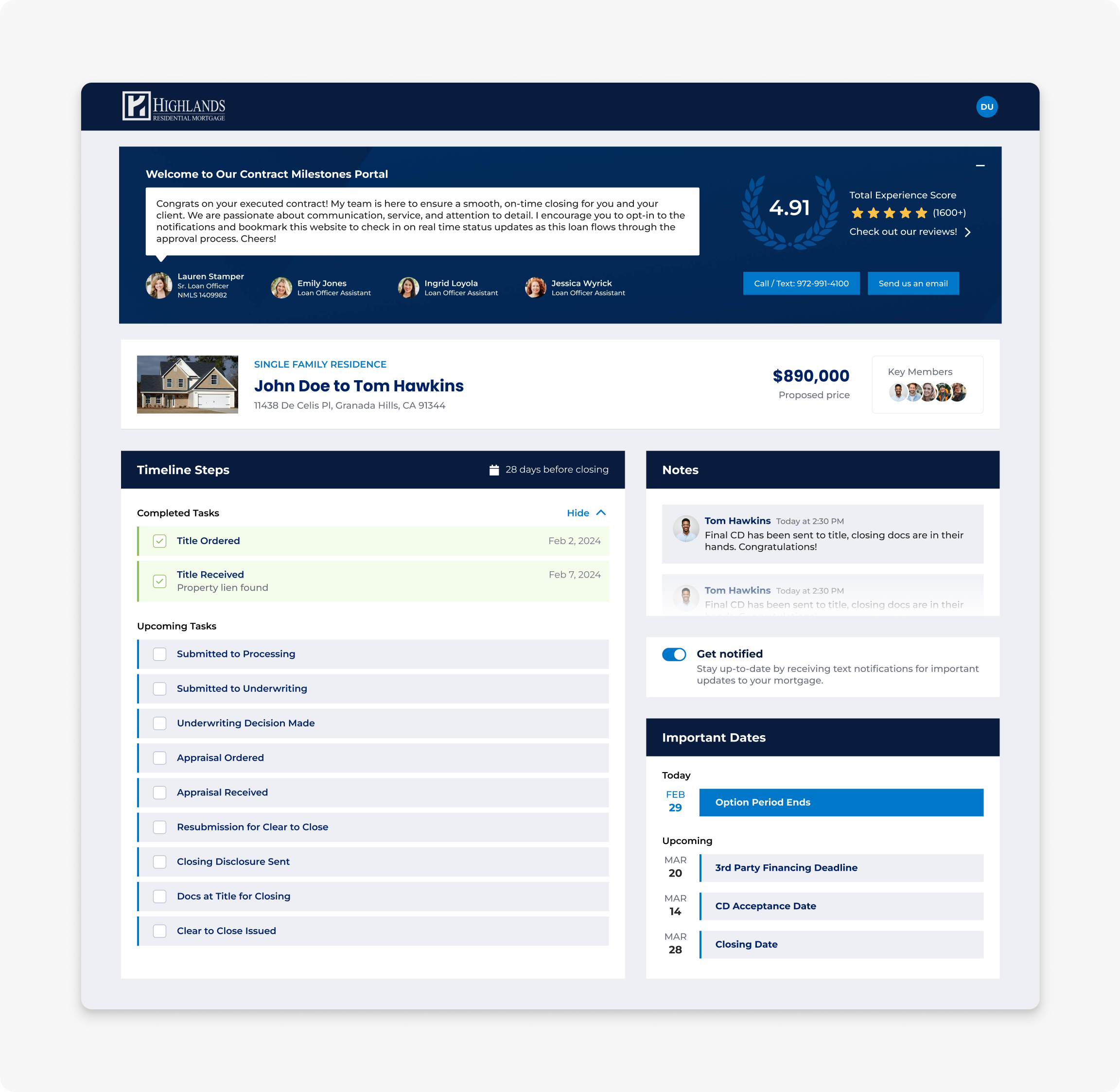

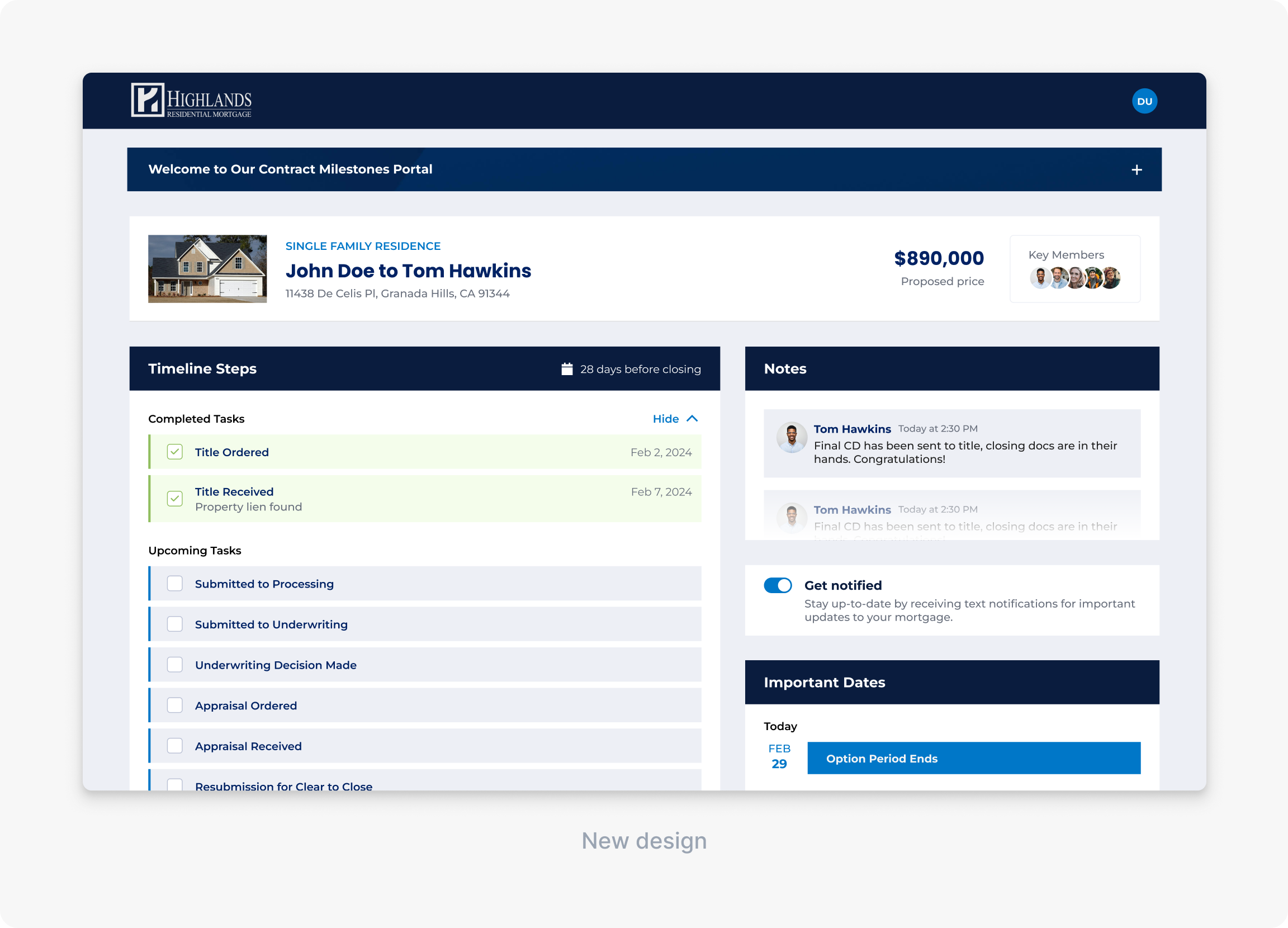

After a discussion with our stakeholders, we redesigned the interface to prioritize status indicators over listing details. These indicators now highlight specific actions agents need to take, making the portal more action-oriented and user-friendly. This change helps realtors focus on important tasks and manage their workflow more efficiently.

The portal we prioritized were the following features:

Timeline Steps: A visual progress bar for each transaction that displays whether underwriting is complete, documents are collected, appraisals are ordered and completed, and the file is cleared for closing. These indicators were designed to be simple, color-coded, and easy to interpret at a glance.

Key Member Notes: As soon as a milestone is completed (like the appraisal being complete or underwriting finished), loan officers can leave notes or messages to update the parties, ensuring that everyone has the latest information without having to chase down updates.

Notifications: Opt-in email notifications and alerts to inform users of important updates or changes to their file.

Important Dates: A calendar to track and anticipate key activities throughout the lending process.

The result: An improved communication flow between loan officers and real estate agents

The key benefits included:

Increased Transparency: Realtors no longer had to call or email for updates. The status of each mortgage was always available, providing a new level of openness and confidence in the process.

Improved Efficiency: With real-time updates and notifications, realtors spent less time chasing down details and more time focusing on closing deals. The portal reduced unnecessary back-and-forth communication, speeding up the overall process.

Fewer Delays: The ability to quickly identify critical issues, such as missing documents or appraisal delays, helped realtors act proactively, minimizing delays that could have disrupted the closing process.

Enhanced User Experience: Feedback from agents indicated that the portal was easy to use and integrated seamlessly into their daily workflows, allowing them to track the lending process with minimal effort.

Through this project, we demonstrated that simplifying complex processes and making key information easily accessible can have a transformative impact. By listening to the needs of loan officers and agents alike, and understanding their daily frustrations, we were able to craft a solution that addressed their specific pain points.